The longer you’re in the markets, the less scared you get.

One of the truisms of finance is that markets are intimidating when they are unfamiliar. This is one reason why many institutional investment firms such as hedge funds, investment banks, and mutual fund managers hire so-called “specialists.” These are analysts and portfolio managers who have experience in their particular asset class and sector. For instance, a REIT fund will tend to hire analysts with experience analyzing real estate and REITs—a commodities analyst may be familiar with REITs, but those first few months will be intimidating. And for some people, it will take years for that intimidation to disappear.

This is one of the subtler aspects of investor psychology that is extremely important, but most analysts are blissfully unaware of. To take a recent example, let’s look at Apple (AAPL).

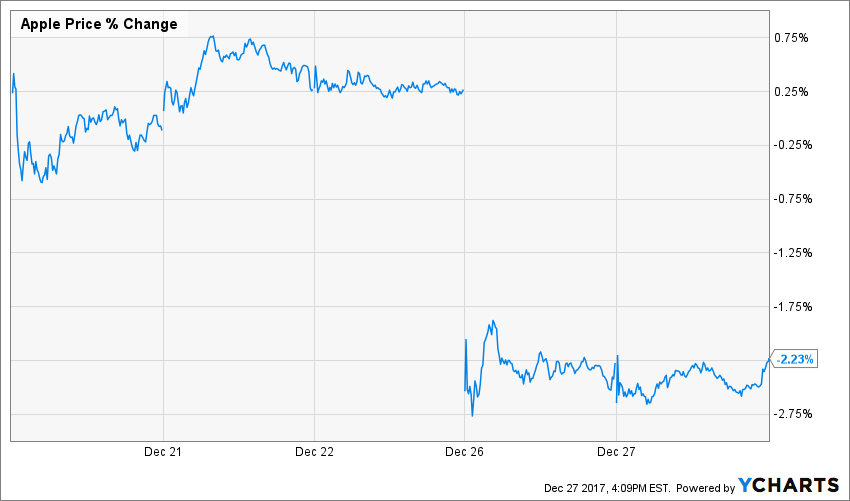

Apple stock fell steeply and suddenly at the end of last year after a tremendous, impressive run up:

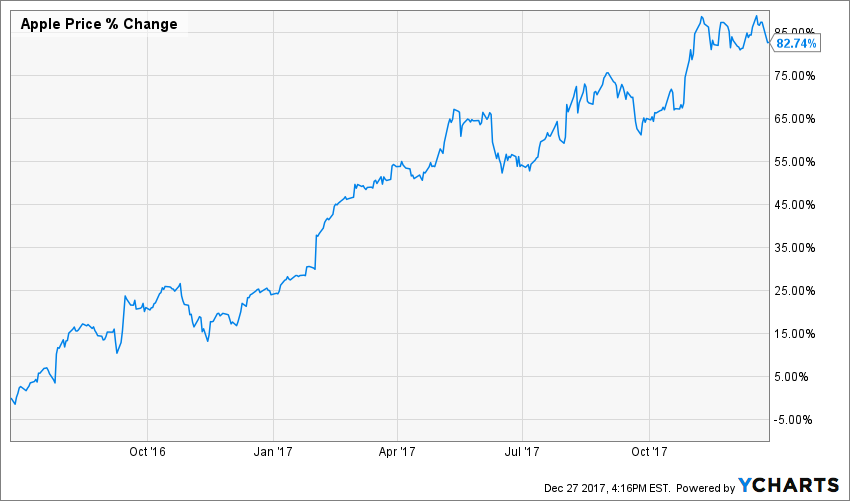

That sudden drop looks terrifying, although a bit more history shows it really doesn’t mean much:

Still, a lot of investors are suddenly scared. The reason is that the driver behind that decline is fundamental.

It all began with a sell-side analyst’s report. These things usually do. Analysts noted “lukewarm demand” for the iPhone X due in part to its high price point and in part to disappointments with the phone’s features. The news first hit Bloomberg, but it spread to CNN and other more mainstream outlets. At that point, the damage was done. Not only analysts, but fund managers and individual investors were beginning to wonder if the tremendous 50% run up in Apple stock price for 2017 was too much, and it was time to take profits.

And take profits they did. That sell-off pressure resulted in newer analyst reports dismissing the previous analyst reports, with industry analysts noting that many new Apple device activations in the holiday season imply the phone is a success. Actual Wall Street analysts remain skeptical, so the stock price has flatlined.

If you’re relative new to markets and you’ve seen Apple’s stock soar, this might be a time for real panic. The idea of a 50% stock run up in one year is tremendous, especially for a mega-cap stock like Apple. The warnings thus make sense, and you’d feel justified in taking money off the table.

This is really bad investing, however.

This same fear happened in early 2016, and investors felt good about staying away when the stock did this:

At that time Apple’s P/E ratio fell to less than 13—a number that value investors with experience in the market repeatedly said was absurd. And, unsurprisingly, the stock’s P/E ratio rose to the high teens since then as this panic selling stopped and reversed, causing this:

This doesn’t mean Apple is a good buy right now or that the sell-off now is unjustified. What it does mean is that investors need to have solid, firm data to justify buying or selling Apple—much more than a gut feeling that there’s been too much profits lately or that maybe a product isn’t as good as people had expected.

The smart money is very heavily invested in Apple. It’s a major holding of many hedge funds and mutual funds. Many will probably ignore the recent selloff and do their own due diligence (talking to industry sources, speaking to insiders and consultants, and maybe even spending some time visiting a few Apple shops themselves) to see if the supposed unpopularity of the iPhone X is an urban legend or a reality. Those who get the best intelligence will end up making the best investment decision—and earn the highest profits from either selling early (and not as a reaction to mainstream news) or holding and buying during the downturn.