Every time a major index approaches a round number—15,000, 20,000, and so on—the mainstream media likes to insist that there is no significance to this number. The way this is framed is itself quite interesting, because it is a meta-psychological manipulation.

This is an abstract idea, so let’s explain it with an example. NPR, one of the more staid outlets, has a story urging people to “not believe the hype” about Dow 20,000. Here’s the intro to the news piece:

“You may have heard about a big milestone coming up for the Dow Jones Industrial Average. It’s been all over the news: The Dow is creeping up towards twenty thousand. It’s been hovering just below that mark for weeks now. And people are kind of freaking out. But here’s the thing about the Dow: It doesn’t matter.”

Planet Money goes on to make some good points, like the fact that the Dow Jones is a terrible index. But NPR also ignores one important and very subtle fact about these round numbers that does have a very small but nonetheless important impact on financial markets.

Round numbers provide resistance points for stocks. While many financial professionals avoid technical analysis almost all of the time, it still has a place in the financial world. The CFA curriculum includes in-depth study of technical analysis, acknowledging its limitations but the importance of some key concepts. There are times when TA is extremely important, and round numbers is one of them. This means that investment strategies fundamentally change when we are near a round number.

The existence of these stronger resistance points at times like these also creates another change in financial markets: volatility acts fundamentally different. Generally, as an index gets closer to a round number, volatility will fall as the upward pressure on stocks keeps them from falling too much, but the downward pressure of the resistance point (in this case, 20,000 for the Dow) keeps stocks from going up. This forces stocks to remain in a narrow band, in turn limiting their volatility and thus lowering the premium on options and lowering the volatility index for that stock index.

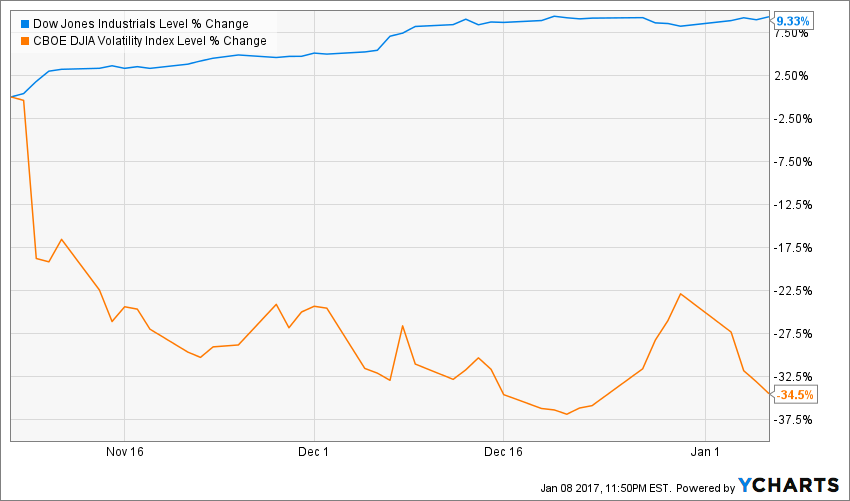

We see this at play with the Dow Jones and its little-known volatility index (VXD):

The index started to flirt with 20,000 in late November, when volatility crumbled. That has continued to be the case, and volatility has fallen as it got closer and continued to bump against 20k. There was a brief reprieve in the lower volatility of the market at the end of December, possibly due to tax-loss harvesting putting selling pressure on the index. A closer look at the Dow Jones price level then demonstrates the uptick in volatility:

Here we see the sudden decline in the Dow Jones that caused VXD to fall. The upward pressure of the 20k resistance was still there, and the selling pressure of tax-loss harvesting was augmented.

What this meant for traders is obvious: a clear opportunity to sell volatility at the end of December, buy the Dow Jones, or both. In other words, the presence of the round number and the technical resistance it provides created a trading opportunity.

These are rare. Discretionary short-term trades are very rarely permitted in institutional investment firms, but situations like this create valuable exceptions.

Of course, this has little impact on the average investor, who shouldn’t be thinking about short-term price movements anyway. But for financial professionals, these things prevent tremendous opportunities and have important value. This is just another instance of how institutional and retail investors need to think differently—and often do.