2018 might seem like an exciting year for stocks, especially if you’re relatively new to the markets and have never experienced a bear market. Not since 2014 have we seen such a sharp decline in equities in such a short time period, and the early February meltdown of stocks (and meltup of the VIX) caught many investors, especially younger ones, by surprise.

If you thought that meant stocks were doing poorly, think again. Also, if you thought stocks were acting “unusual” or in a way to warrant extra caution—again, reconsider.

So far, the stock market is up 2.3% YTD, which is still about 14% annualized, or about 75% higher than the long-term average.

As for the VIX—while its gotten to its psychologically important 20 level (which, in the early 2010’s, was seen as an opportunity to short the VIX), it’s still pretty low by historical measures:

Thus while there is an expectation of greater volatility than we saw in most of 2014-2017, it’s no greater than what we’ve seen over a longer historical timeframe.

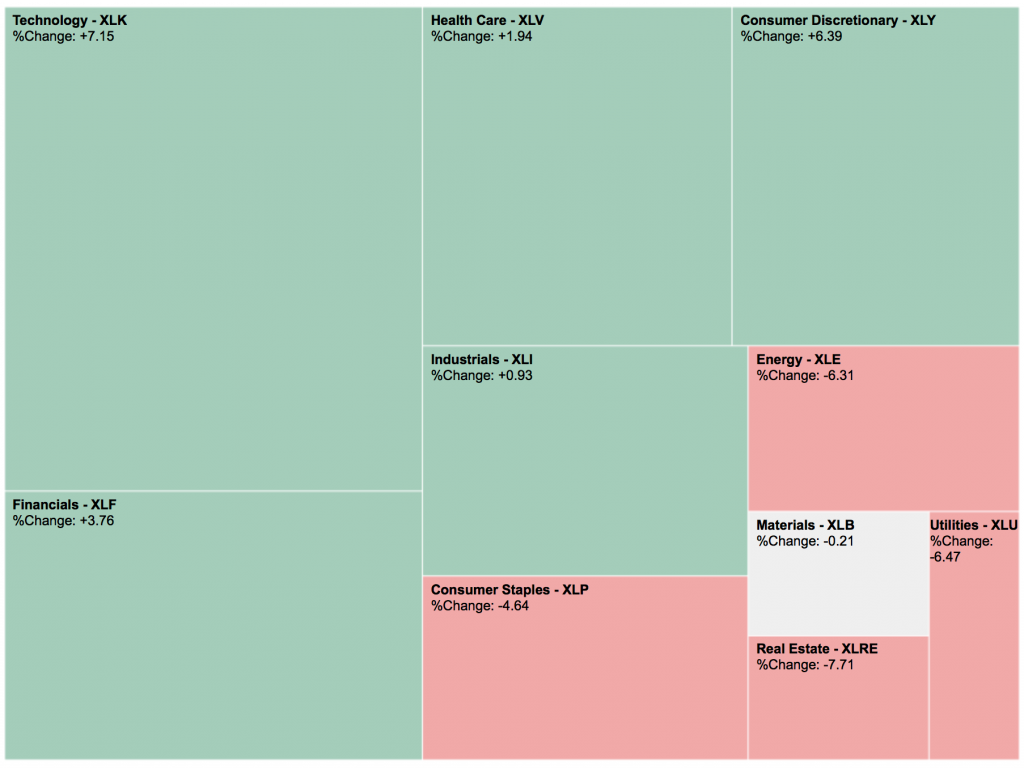

On a sector by sector basis, we can see the market is far from in a “risk-off” mode:

One of the worst sectors is utilities (XLU), down 6.5%. This safe harbor often attracts investors afraid of a market downturn who still want a high stream of income. This decline has been dismissed as a result of higher interest rates—which could entice risk averse investors into Treasuries and out of riskier utility stocks.

There are two big flaws in that argument.

The first is the fact that utilities have been doing very well since interest rates started going up in December 2015—in fact, that is the starting point of their recent bull run:

Additionally, consumer staples—which yield much less and are considered more of a countercyclical store of value than a yield trap—are down almost as much, at 4.6%. That decline coincides with a higher increase in consumer discretionary stocks, which are companies that investors tend to prefer when they see a stronger, improving economy.

For this reason, despite the slightly elevated (by recent historical comparison) VIX and the “shocking” decline in early February (which has mostly vanished since then), the market isn’t showing indications of panic, caution, or of feeling a downturn is coming.

Does this mean the economy is strong and stocks won’t fall? Of course not. And the market could be entirely wrong, remaining relatively healthy and resilient despite more important fundamental flaws. But the important point is that the market is feeling healthy right now.

And it’s now up to every analyst to take the market’s temperature, and see if the market is as healthy as it feels or if there’s a much deeper malaise lurking under the surface.