Sector rotation is an essential concept in equity investing and has been a strategic outperformer in recent months. The concept is somewhat simple but often overlooked: identify sectors that have recently underperformed and invest in them, wait for them to outperform other sectors, and then rotate back into those underperforming sectors.

The speed and degree to which investors will shift from one to the other varies on many factors, including individual investing goals, market outlook, the macroeconomic environment, and the appeal of alternative strategies. For example, finance was a massive underperformer in 2007-2009 for obvious reasons; however, it stayed an underperformer well until 2016 due to the lingering effects of the financial crisis, structural changes in the finance sector, and the Central Banks’ market intervention programs that starved banks of easy profits.

Rotating into financials during their underperformance in the late 2000s and early 2010s would have been a disastrous approach, and that is one of many reasons why sector rotation has largely fallen out of favor. Ironically, sector rotation has also become massively easier; the Select Sector SPDR group of ETFs help investors choose one sector, such as technology (XLK), consumer staples (XLP), energy (XLE), and so on. They can then put their assets in one of these ETFs and track the sector with relative ease.

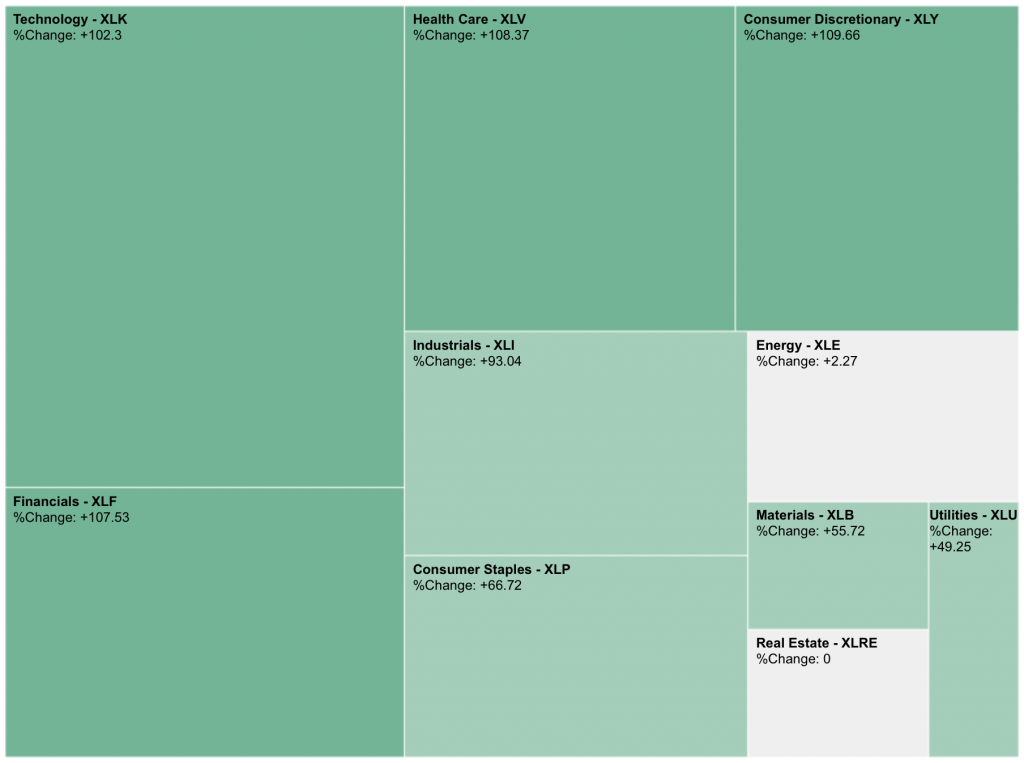

Interestingly, although we have had a long-running bull market, the returns in different sectors vary wildly, with some massively outperforming others. As you can see from the head map below, real estate (XLRE) and energy (XLE) are dragging down the rest of the market, which is being held up by consumer discretionary (XLY), financials (XLF), health care (XLV), and technology (XLK):

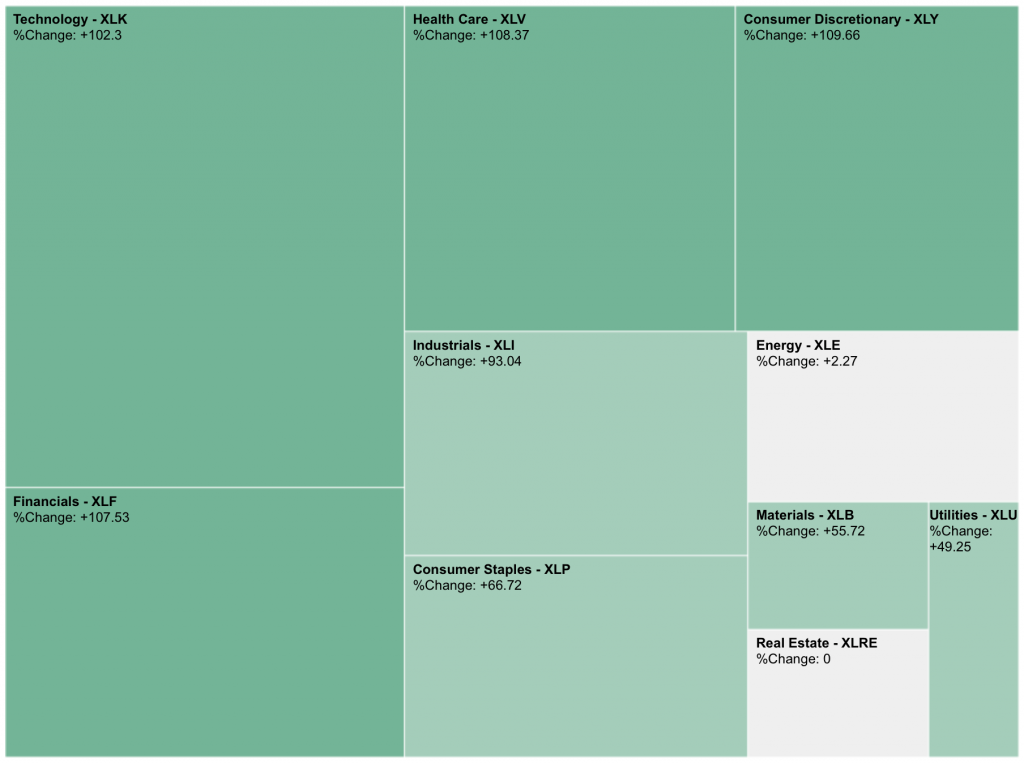

Looking over the past year, things look almost identical, with those same two sectors dragging everything else down and XLK, XLF, XLY still being leaders, although industrials (XLI) and health care (XLV) are not where they were on the 5-year heat map:

Looking over the past year, things look almost identical, with those same two sectors dragging everything else down and XLK, XLF, XLY still being leaders, although industrials (XLI) and health care (XLV) are not where they were on the 5-year heat map:

However, the snapshot we get of markets right now is slightly misleading. At the end of 2016, energy was one of the market outperformers, with XLE 15% higher than it is now:

However, the snapshot we get of markets right now is slightly misleading. At the end of 2016, energy was one of the market outperformers, with XLE 15% higher than it is now:

Having bought into XLE before or during that run up and selling shortly thereafter would have capitalized on the unusual and aberrational trend of XLE outperforming despite the longer-term trend of it underperforming.

This is a new layer of complexity with sector rotation that requires more complex math and analysis: identifying the cyclical oscillations between highs and lows in combination with a secular tendency for the sector to go up or down. This analysis is complicated but, when done well, can help investors retain diversification among a number of stocks while also identifying where the greatest value and potential returns may be. This is a key strategic skill portfolio managers must have, and one that equity analysts should consider gaining early in their careers